Winlock School District Levy - April 22, 2025

Revised Proposal at a Lower Rate

April Educational Programs & Operations (EP&O) Levy Facts

This April, Winlock School District will once again ask our community to renew an Educational Programs & Operations (EP&O) levy that replaces two expiring levies. We listened to our community and have reduced our requested levy amount to keep the total tax rate the same as the current rate.

The proposed two-year levy provides funding for services, programs, and security improvements that are not fully funded by the state, including:

Safety & Security (updated security systems, cameras, door locks at both schools) - 100% levy funded

Athletics - 100% levy funded

STEAM learning support - 100% levy funded

Technology (student devices; classroom technology) - 100% levy funded

Special education

After-school programs

Music, librarian, nurses, counselors (staff positions not fully funded by the state)

Academic and behavior support and curriculum updates that foster meaningful and up-to-date learning.

Local levies fund local priorities, and more…

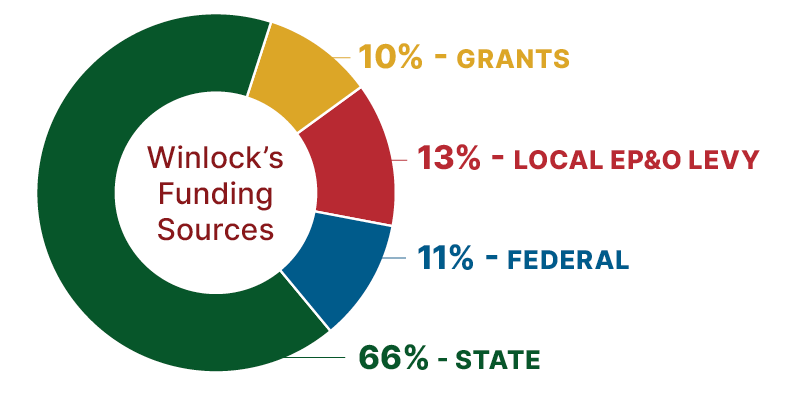

Even with some recent investments, the state of Washington does not fully fund public K-12 education. EP&O levy funds make up 13% of Winlock School District’s operating budget and fill the gap between the funding provided by the state and the actual costs of educating students.

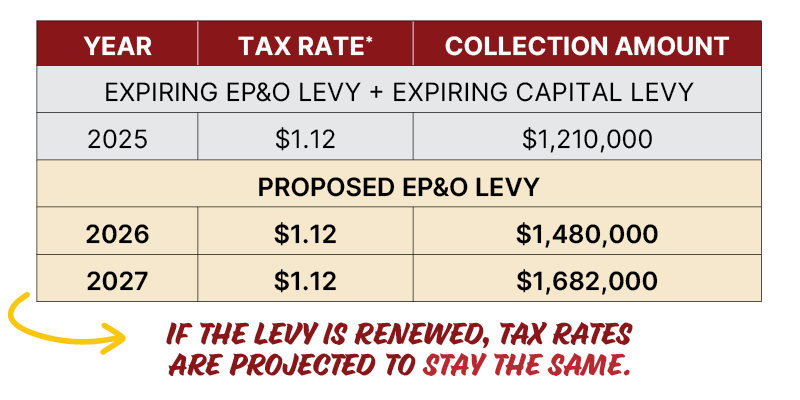

Estimated cost to local homeowners

For the average owner of a $400,000 home in Winlock, the proposed levy would cost no more per month compared to 2025. We’re listening to our community: The rate at $1.12 per $1,000 of assessed value is well below the maximum rate of $2.50 set by the state.

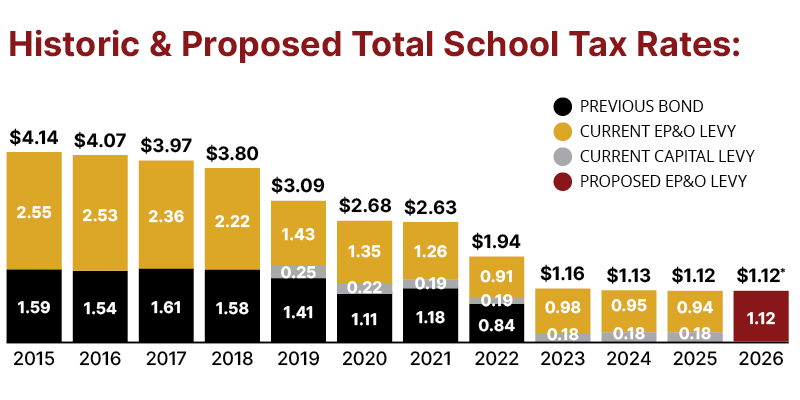

Tax rates will stay at historically low levels.

Winlock's school tax rates are lower than they've ever been, and the April levy renewal will keep rates at the same low level.

*Estimates, based on current trends. Rates and homeowner costs may fluctuate depending on community growth and home valuations. Rates are per $1,000 assessed home value. The district cannot collect more than the amount approved by the voters. Increases in property values do not generate more revenue for the district.

VOTER INFORMATION

How do I register to vote?

Washington State makes it easy to register online, by mail, or in person ( at a county elections office). Find more information at: www.elections.lewiscountywa.gov/voter-registration/

Are tax exemptions available?

Yes, Washington State law provides two tax benefit programs for senior citizens and individuals who are disabled: property tax exemptions and property tax deferrals. For more information on qualifications, please contact your local county assessor's office.

Lewis County Assessor

351 NW North St, Chehalis, WA 98532

Phone: 360-740-1392

How can I find out more information?

If you have read the Frequently Asked Questions (below) and you still have questions, please do not hesitate to contact the District Office at 360.785.3582. Our staff are happy to talk to you regarding any aspect of our levy. If you have fiscal-related questions, please contact Michelle Jeffries, Superintendent at 360-785-3582.

Información en español

Frequently Asked Questions